The IRA as an IRA

The Inflation Reduction Act as an Individual Retirement Account

Download the PDF version here.

The Inflation and Reduction Act (IRA) announced last week is going to be a boon to low- and moderate-income American homeowners. The IRA’s home electrification and energy efficiency measures will not only fund critical infrastructure to upgrade our aging housing stock, it will provide vital and long-lasting economic stimulus to millions of American families.

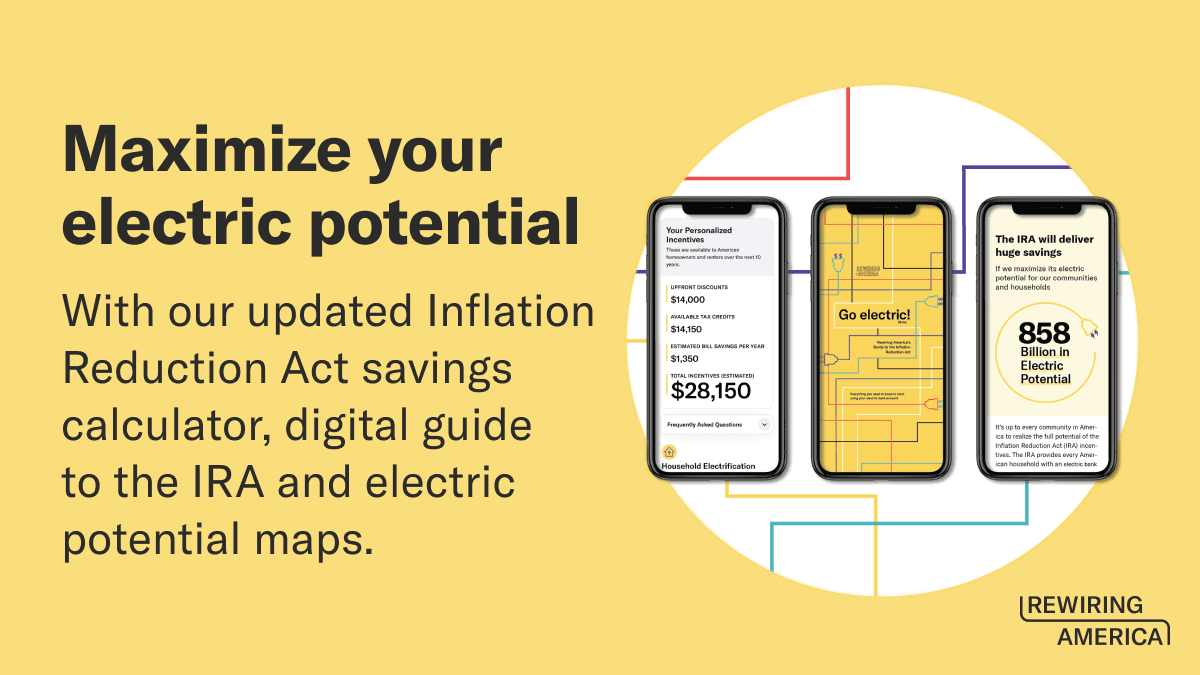

Under the Act, a household making $50,000 per year — about 75% of the median income — will be eligible for up to $14,000 in home electrification incentives. Many will be able to use these incentives and additional federal tax credits alongside state and local incentives to replace their home’s aging water heaters, furnaces, and air conditioners with new modern electric equipment at zero upfront cost. Upgrading homes to be all-electric will not only improve comfort and indoor air quality, but also give these households immediate economic benefits.

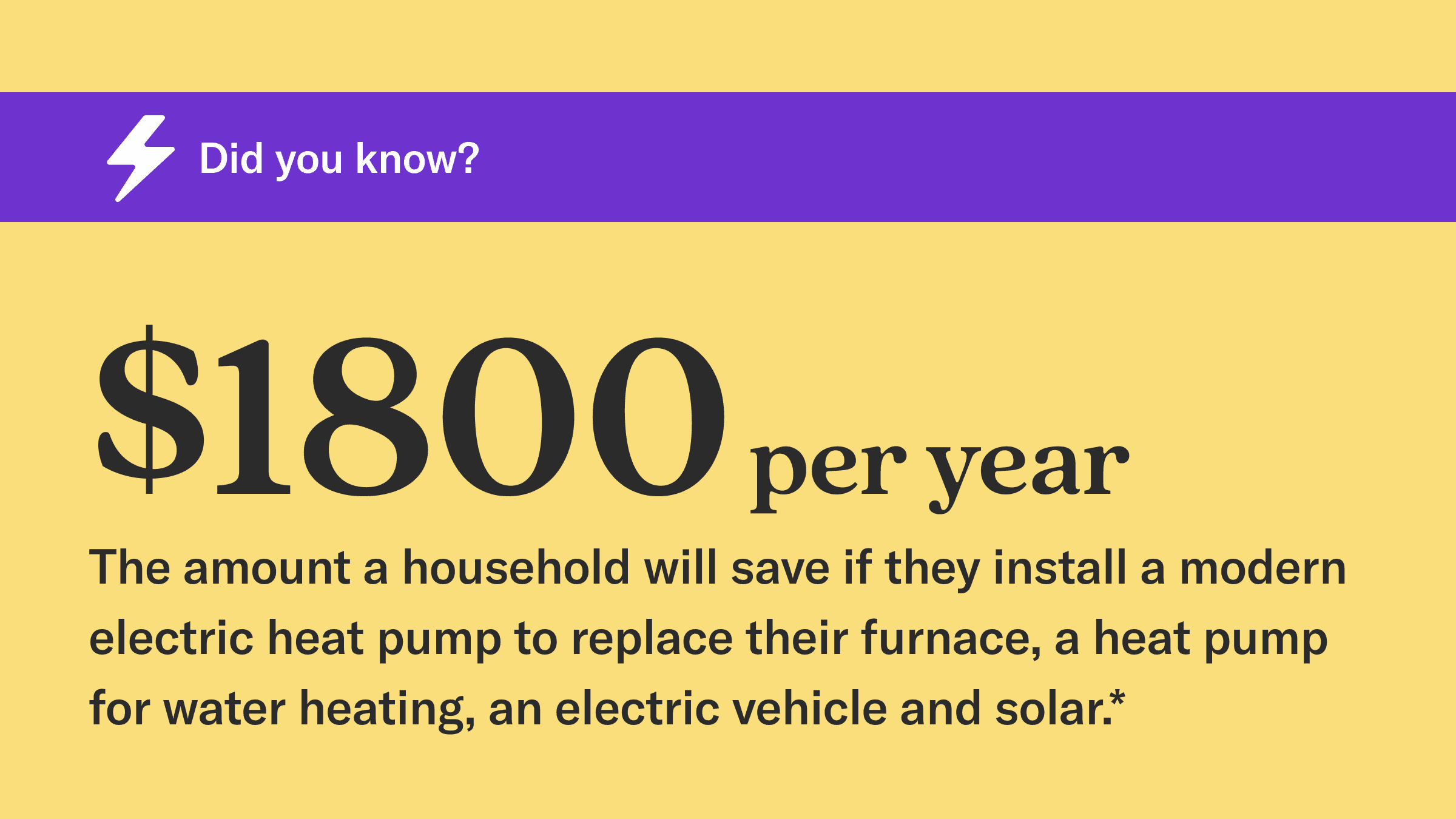

How does this work? As soon as a household goes all-electric, cash savings start to pile up. While their electric utility bills may rise a bit ($430 per year), this increase will be covered many times over by the savings they achieve from eliminating their gas utility bill ($1,100 per year), avoiding ongoing gas utility service charges ($135 per year), eliminating maintenance costs for their obsolete fossil fuel heating equipment ($150 per year), and, most importantly, deferring a series of major one-time future expenses to replace their water heaters and home heating and cooling equipment by 10 years or more.

Those savings add up. If participating homeowners invested these savings with a typical 8 percent rate of return, they would accumulate more than $30,000 after 10 years, and an incredible $140,000 after 25 years. That’s 10 times the amount of the initial IRA electrification incentive package. This is roughly equivalent to the same household putting an additional 3 percent of salary into a retirement account over 25 years; doubling the typical employer retirement matching contribution. This is enough to bring retirement savings rates for low-income families up to par with the national average.

The savings potential for low-income renters are nearly as impressive. While renters are not responsible for equipment installation and maintenance, they will still save big on their utility bills if they can access these efficient technologies. If renters invest these savings at the same 8 percent rate of return they will accumulate more than $80,000 in savings after 25 years. So for both homeowners and renters we can think of this new IRA as being like a more familiar type of IRA, the Individual Retirement Account.

We can also compare the IRA to another recent form of economic stimulus – the 2021 American Rescue Plan expanded Child Tax Credit – which resulted in “improved nutrition, decreased reliance on credit cards and other high-risk financial services, and long-term educational investments for both parents and children." [1]

If a family with three children (two under the age of six) took their additional $4200 child tax credit and invested it for 25 years with 8 percent returns, it would be worth just over $28,000 after 25 years. The provisions in the IRA have the potential to deliver five times as much financial benefit for homeowners and nearly three times as much for renters over the same period, improving health and living standards for decades to come.

Footnotes

[1] Hamilton, Leah, et. al. “The impacts of the 2021 expanded child tax credit on family employment, nutrition, and financial well-being: Findings from the Social Policy Institute’s Child Tax Credit Panel Survey (Wave 2).” Brookings Global Working Paper 173. April 2022.