Cutting home-energy tax credits would hurt households, kill jobs, and strain the grid

What does the Energy Efficient Home Improvement Credit (25C) and Residential Clean Energy Credit (25D) mean for American families and local economies?

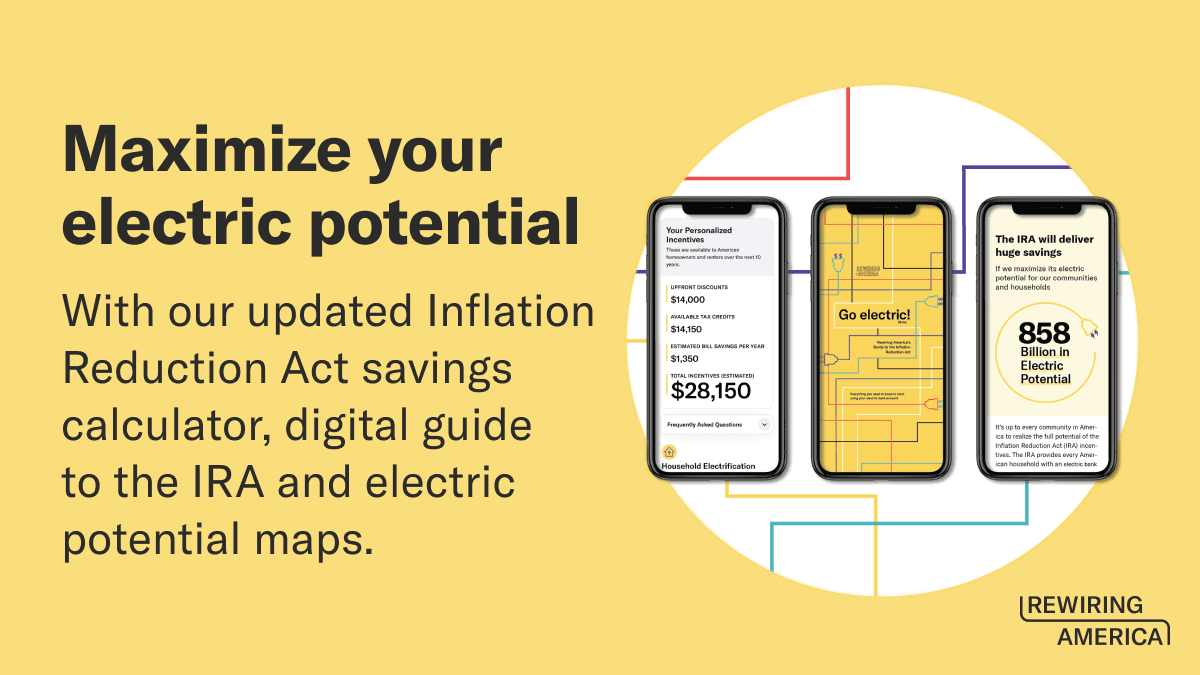

Our new state briefs show just how vital these homeowner tax credits are—helping households afford energy-saving improvements like insulation, air sealing, high-efficiency heat pumps, rooftop solar, and battery storage.

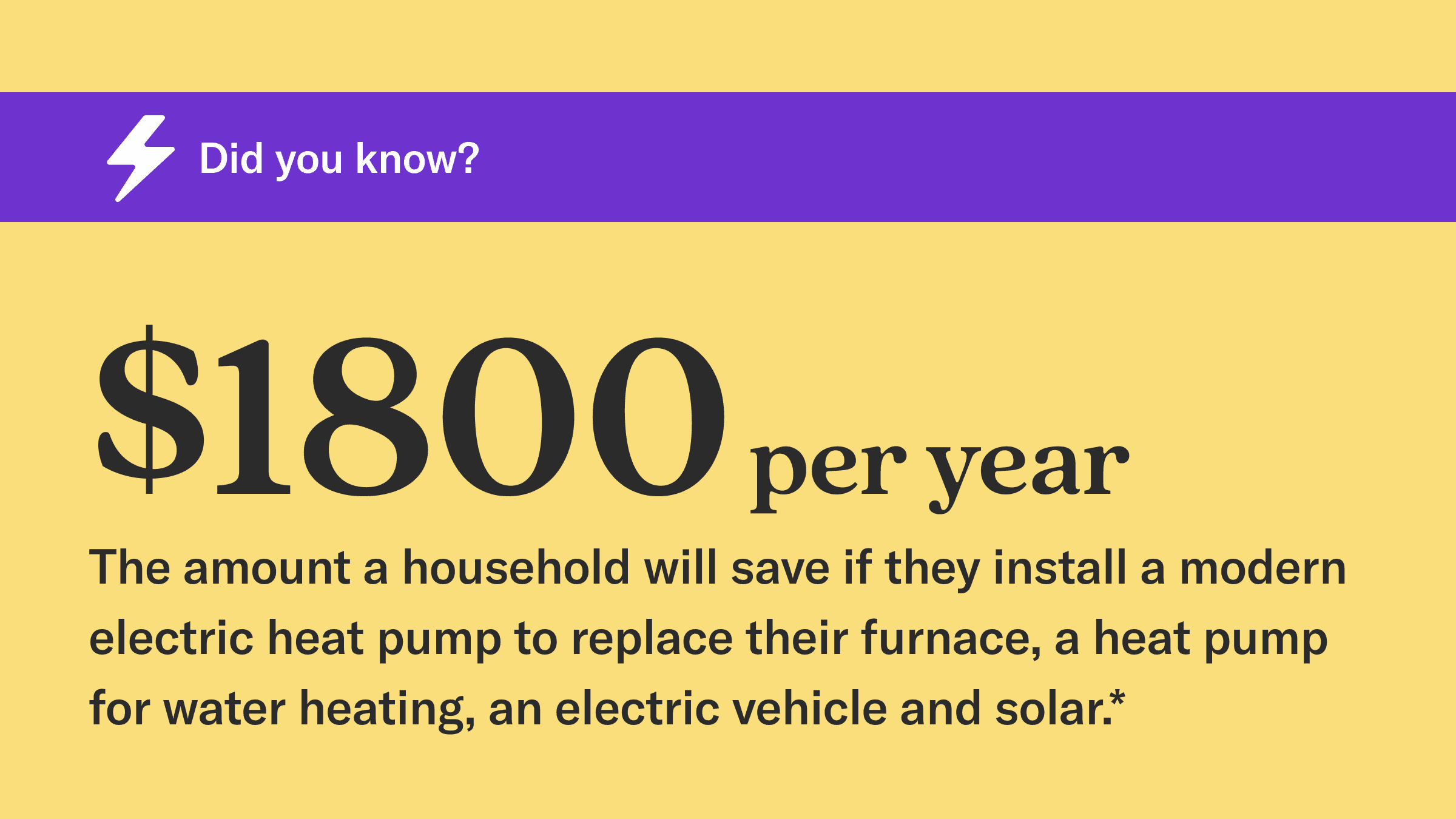

The result? Lower energy bills, more comfortable homes, and more good-paying local jobs in HVAC, insulation, electrical work, and contracting; jobs that can’t be automated or offshored.

In 2023 alone, more than 3.4 million Americans used these popular tax credits to upgrade their homes. Each brief also includes the voice of a homeowner or contractor who’s seen the impact firsthand.

Using state-level data, the briefs highlight what’s at stake if Congress eliminates these credits: higher costs for families, fewer options to upgrade their homes, and more strain on the power grid.