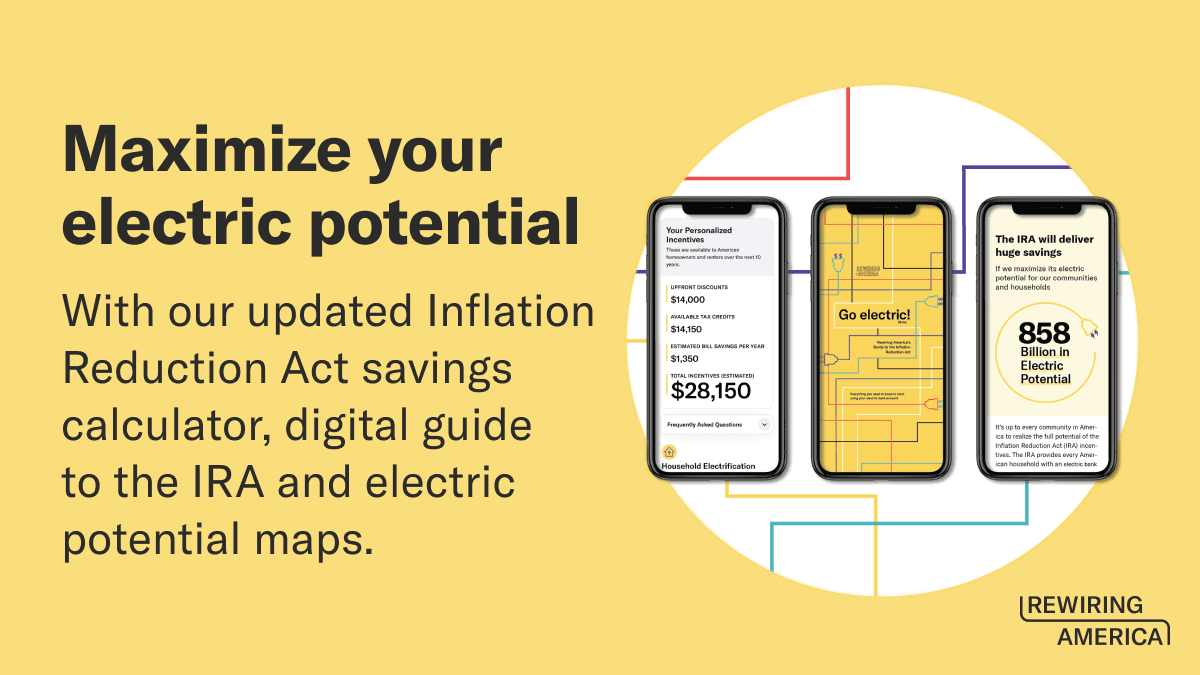

The Inflation Reduction Act explained

Rewiring America breaks down the essentials in this groundbreaking legislation.

At Rewiring America we’re big on "Let’s go!" It’s a rallying cry, an imperative to move quickly towards an electrified future. Because Americans deserve immediate relief when it comes to their energy bills. Because our communities deserve an abundant economic future, with jobs that cannot be automated or offshored. Because our children deserve healthy air, both indoors and outside. And because our planetary future depends on it.

We’re charged with the task of electrifying the world and all the machines in it, on an unforgiving timeline. Tuesday's welcome climate reconciliation announcement is a decisive moment, one that will determine how we live out our days on this beautiful planet. There’s no time to waste.

In the spirit of no time to waste, we put together our analysis of some key programs in the Inflation Reduction Act. An Electric Explainer, if you will. The climate investments are broken up into over 100 programs. Here we detail eleven of our favorites.

1. One million low- and moderate-income households go electric

The High Efficiency Electric Home Rebate Act (HEEHRA), includes $4.5 billion in direct rebates for low- and moderate-income households that install new, efficient electric appliances, using a framework proposed in our Appliance Rebate Plan. For instance, a low income household will receive a rebate covering the full cost of a heat pump installation for space heating, up to a cap of $8,000. This household could receive up to $1,750 for a heat pump water heater, $840 for an electric stove, and $840 for an electric clothes dryer. If required, this household can also receive up to $4,000 for an upgraded breaker box, $2,500 for upgraded electrical wiring, and $1,600 for insulation, ventilation and sealing. For moderate income households, the same rebates are available to cover 50 percent of the costs. This will enable roughly one million low- and moderate-income households to go electric.

In addition, the Inflation Reduction Act includes $4.5 billion in efficiency and electrification rebates under the Home Energy Performance-Based, Whole-House Rebates.

2. Tax deductions for electric upgrades

The Energy Efficient Home Improvement credit, or 25C, allows households to deduct from their taxes up to 30 percent of the cost of upgrades to their homes, including installing heat pumps, insulation and, importantly, upgrading their breaker boxes to accommodate additional electric load. Upgrade costs include both equipment and installation/labor costs. These deductions are limited to $600 per measure, up to $1,200 per household per year—with one notable exception. Households can deduct 30 percent of the costs for buying and installing a heat pump water heater or heat pump for their space heating and cooling, up to $2,000.

The New Energy Efficient Home credit, or 45L, has received a substantial boost, providing up to $5,000 to developers to build homes that qualify for the Department of Energy’s Zero Energy Ready Homes standard. This applies to new single family, multifamily and manufactured homes, as well as existing homes that undergo a deep retrofit.

The Commercial Buildings Energy Efficient credit, or 179D, has been significantly expanded, offering $2.50 to $5.00 per square foot for businesses achieving 25 to 50 percent reductions in energy use over existing building performance standards.

In addition, $30 billion is available as a production tax credit to accelerate U.S. manufacturing of solar panels, wind turbines, batteries and critical minerals processing in the U.S., and another $10 billion is allocated as an investment tax credit for building new facilities that manufacture these technologies.

3. Pumping up the Defense Production Act

The Enhanced Use of the Defense Production Act includes $500 million to bolster the domestic manufacturing of heat pumps and the processing of critical minerals. This is in line with what we called for in our Electrify for Peace policy plan.

4. Zeroing out pollution from dirty fossil gas (AKA methane)

The Greenhouse Gas Reduction Fund provides $27 billion in funding, of which $15 billion will enable low-income and disadvantaged communities to benefit from zero emission technologies and other greenhouse gas pollution reductions. This follows recommendations we made in our report on using these dollars to Rewire Communities. The Methane Fee would impose a fee for emitters of up to $1,500 per ton of this potent greenhouse gas in 2026.

5. Charging up EV adoption

The Clean Vehicle credit, or 30D, gives a $7,500 credit for new electric vehicles and a $4,000 credit for used electric vehicles. This will help everyday Americans afford to get an EV and start saving money every month. Operating an EV costs $1/gallon, which is way more affordable than an internal combustion engine car. This incentive will make clean cars the default and affordable choice for everyday Americans.

6. Residential solar and battery storage credits

The Residential Clean Energy credit, or 25D, re-ups an existing program allowing households installing solar to deduct 30 percent of the cost of the project from their taxes. This credit is guaranteed for 10 years, and now also includes residential battery storage systems.

7. Supporting environmental justice communities

The Environmental and Climate Justice Block Grants program is funded at $3 billion and enables disadvantaged communities to reduce greenhouse gas emissions, mitigate risks from extreme heat, improve climate resiliency and reduce indoor air pollution.

8. One billion dollars for affordable housing

The Improving Energy Efficiency and Water Efficiency or Climate Resilience in Affordable Housing (formerly known as the GREAHT Act) includes $1 billion in grants and loans for retrofit projects that advance building electrification, improve energy and water efficiency, and more in affordable housing.

9. Investments in tribal communities

The Tribal Electrification Program will provide $145 million to help tribal communities transition to clean, zero-emission, electric energy systems.

10. The code to zero

The Zero Building Energy Code Adoption provision invests $1 billion to ensure that more Americans are able to live and work in zero-emission buildings that meet the highest standards for energy efficiency, which will minimize energy bills, and improve health and safety.

11. Loans for clean energy investments

The Funding for Department of Energy Loan Programs Office (LPO) provision will provide LPO $3.6 billion to guarantee loans up to $40 billion in principal amounts. These investments will spur the deployment and adoption of innovative clean energy technologies.

Electrification zaps fossil-flation

We've been working tirelessly to make sure people know that it's fossil fuels that are responsible for the bulk of inflation. Writing in an op-ed for The Hill this week, our CEO, Ari Matusiak, said:

The solution is clear: Let’s get off fossil fuels and power our lives with plugs, not pipes.

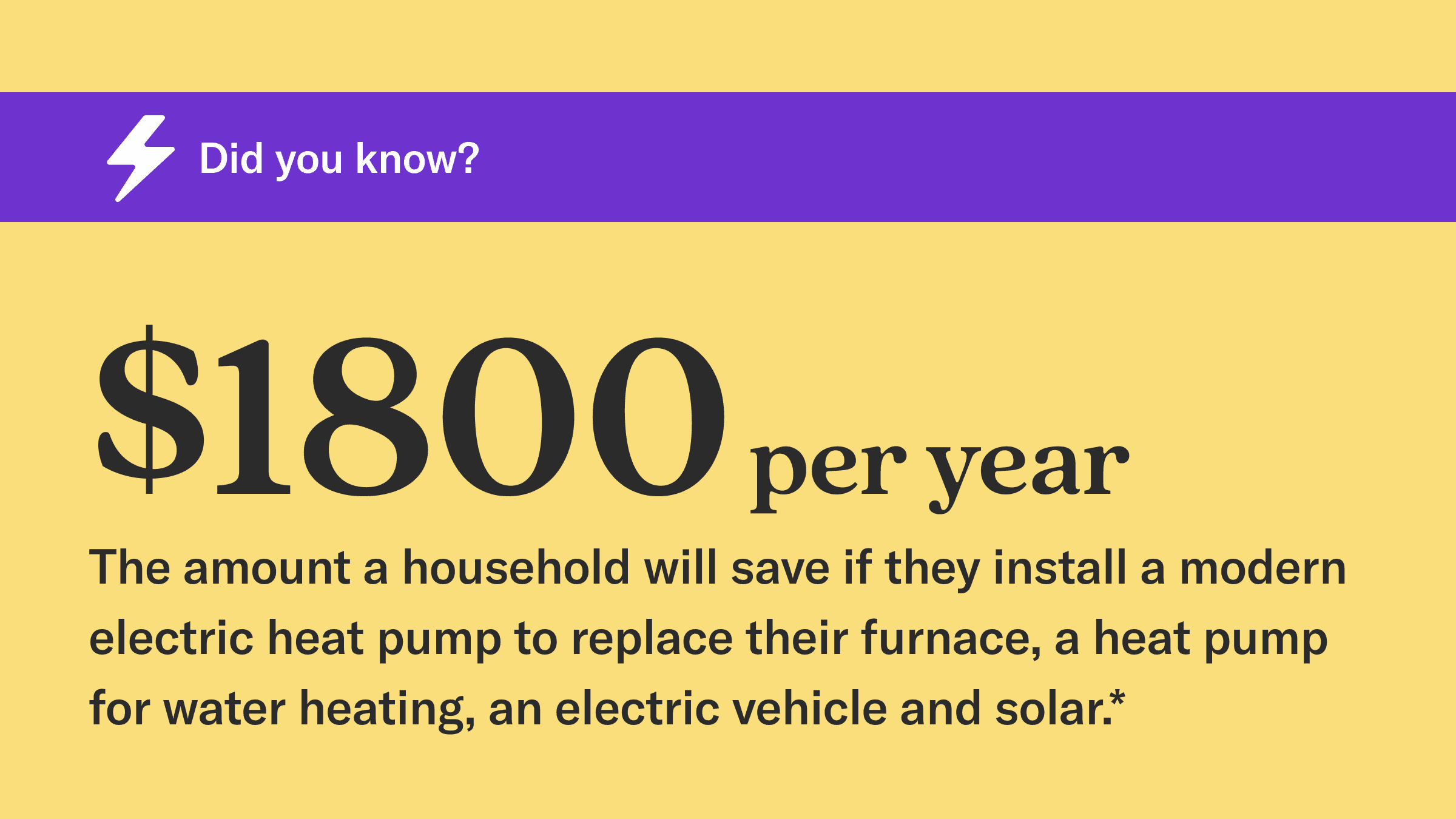

Electrification both mitigates climate effects and creates stability. While gasoline hit a record $5 per gallon in June, driving an electric car costs the equivalent of just $1.06 per gallon today. Electric heat pump technology is so efficient that — when paired with congressional investments — the average American household would have saved $970 in energy bills if they electrified last year, and $1,350 if they had also installed solar panels. If current prices hold over the next year, these savings will grow to $1,420 and $1,840, respectively.