FEDERAL CLEAN VEHICLE CREDIT (30D)

New EV tax incentive (30D)

The 30D new electric vehicle tax incentive makes it more affordable for Americans to purchase a new electric vehicle (EV). You can claim this incentive if you are eligible and purchase your new vehicle from a registered dealership.

View other tax credits for EVs:

Jump to section

Introduction

Introduction

Disclaimer: The information presented here is for educational purposes only. It is not intended to provide specific tax guidance. For questions regarding your individual tax situation, we suggest consulting with your tax advisor.

Tax Credit

Up to $7,500

Available now

Starting in 2024, this credit can be transferred to dealerships in exchange for a point-of-sale discount, reducing the amount you pay the dealership at purchase.

This protocol for using the 30D tax incentive went into effect on January 1, 2024 and it was different in prior years. To use the 30D tax credit for a new EV you purchased last year (2023), you must claim it as a tax credit when you file your income tax return.

Who qualifies for the 30D new EV tax incentive?

Incentives are limited based on income. Here’s what you need to know.

Individuals and households that meet income requirements

New EV purchases are subject to income caps based on income tax filing status. Those caps are:

$300,000 for married couples filing jointly

$225,000 for heads of households

$150,000 for all other filers

If you fall at or below the income cap for one of these categories, congratulations—you're eligible for a 30D tax incentive!

If you fall above your designated income cap, or think you might by the end of the tax year, do not claim this incentive! You will be required to pay it back.

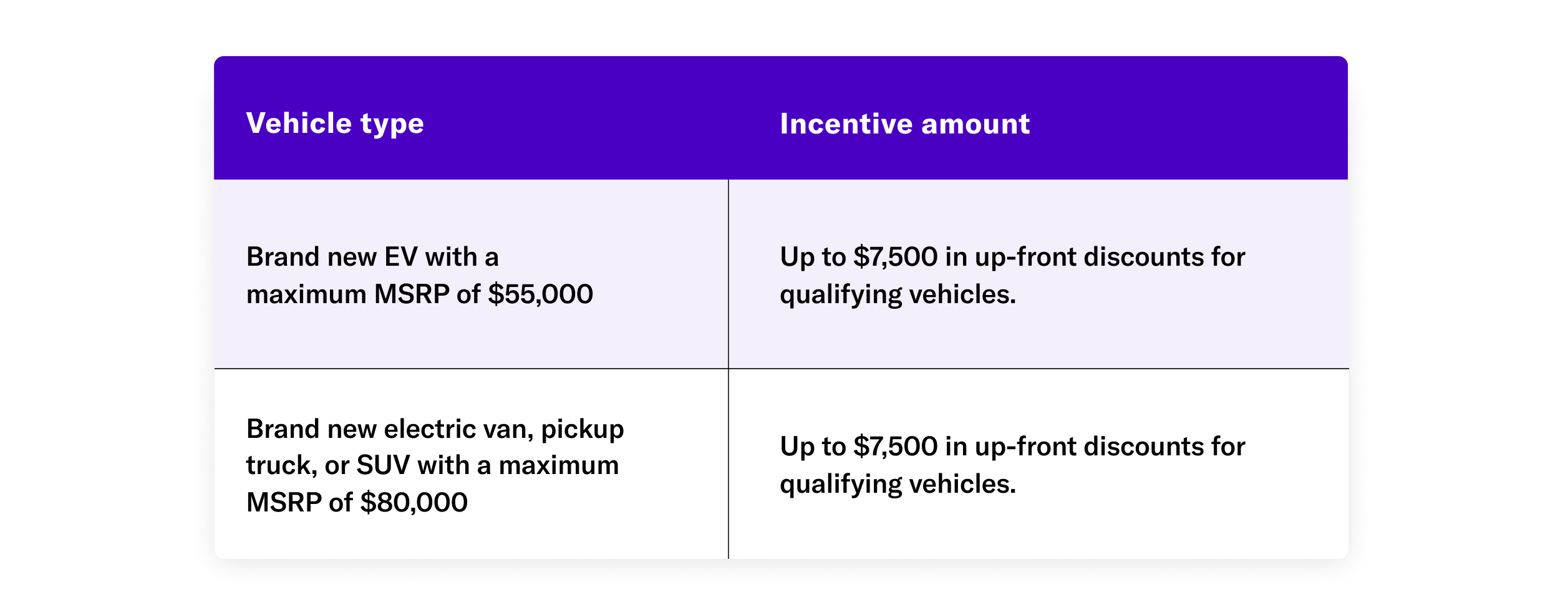

Which new EVs qualify?

New EVs must meet IRS requirements in order to qualify for a full or partial tax incentive. Battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) both qualify, but traditional hybrid vehicles (without a charging plug) do not.

There are tons of new EVs on the market, but not all of them qualify for the 30D tax incentive, and some might only qualify for half of the incentive. Some EVs that qualified for this tax incentive in previous years no longer do.

To make sure that the EV you want to purchase qualifies for this tax incentive, talk to your dealer before making a purchase. They are required by law to provide you with the information you need to know if a car qualifies.

You can also look up information about whether a specific vehicle qualifies for a 30D tax incentive on this federal government website.

If you’re interested in learning about requirements that new EVs must meet, we’ve broken them down below:

Qualifying new EVs must meet manufacturing and geographic requirements

To qualify for the 30D tax incentive, a new EV must meet the following requirements:

Have a battery capacity of at least 7 kilowatt hours

Be rechargeable using an external source of electricity

Weigh less than 14,000 pounds

Be made by a qualified manufacturer and purchased new

Have final assembly in North America

EVs also have to meet battery and minerals sourcing requirements

If you started driving your new EV on or after April 18, 2023, it must meet federal requirements for battery components and critical minerals to qualify for this EV incentive.

If your new EV meets some or all of these requirements, you’ll be eligible to receive:

$3,750 if the vehicle meets the critical minerals requirement only

$3,750 if the vehicle meets the battery components requirement only

$7,500 if the vehicle meets both

It’s important to ask your dealership which incentive level your potential new vehicle may qualify for.

You can learn more about these requirements here.

How to use the 30D new EV tax incentive

Make sure you’re eligible, claim the incentive when you purchase, then submit IRS Form 8936 with your federal tax return.

Here are all the steps you need to take to save on your new EV.

Verify with your car dealer that you meet income requirements and that your new EV meets vehicle requirements alongside minerals requirements, battery requirements, or both. Ask to see official documentation verifying your car dealer and new EV’s eligibility. Tell your car dealer that you’d like to use the 30D new EV tax incentive to either reduce the purchase price of the vehicle or receive cash back, depending on the options your dealership offers.

When completing the sale of your new EV, your car dealer will electronically submit information verifying the transfer, include a time of sale report, and provide you with written confirmation that your new EV qualifies and the credit amount it qualifies for.

Fill out and include IRS Form 8936 (including your VIN) to show that you claimed the 30D New EV tax incentive. Submit this form with your federal tax return for the year in which you took ownership of your new EV.

Remember: The steps listed above for claiming the 30D tax incentive are new and went into effect on January 1, 2024 and were different in prior years. In 2023 and earlier, 30D was claimed as a tax credit upon filing income tax returns for the year in which a new EV purchase was made.

The big difference now is that you can receive the 30D tax incentive as a discount at the time of EV purchase rather than waiting to receive it as a refund when you file your income tax return.

Be sure to review this information from the US Department of the Treasury to ensure you follow the right steps for the year in which you’re claiming the 30D tax incentive.

Discover other incentives with the incentives calculator!

There are other incentives that you may qualify for. Our incentive calculator will show you a personalized list of incentives.

Go to Incentive CalculatorHelpful tools

Personal Electrification Planner

Interested in upgrading your home to all-electric appliances and vehicles? Generate a personalized electrification plan based on your particular home, lifestyle, and priorities — all in just a few minutes.

Incentive Calculator

Find out how much you could save with tax credits and rebates for heat pumps, water heaters, electric vehicles, electric stoves, rooftop solar, wiring upgrades, and energy efficiency improvements to your home.

Drive electric

Better, faster, cleaner, cheaper? Learn about the costs, savings, and health benefits of electric vehicles—and say goodbye to gas for good.

Want to learn more about electrifying everything?

Join millions of households who are going electric. sign up for free electrification tips, explainers, advice, and more.